The satellite market has started evolving commercially in this decade as the space industry’s focus is more inclined towards making services more affordable for terrestrial purposes. This has ultimately paved the way for the non-space community to step into the multidisciplinary shoes of the space industry. While this decade has recorded a wave of technological innovation in the satellite industry, the communication segment is at the forefront of the New Space era. During this time, a significant number of companies decided to target Low Earth Orbit (LEO) to explore potential communications market opportunities. On the other hand, several chose to reincarnate traditional Geostationary Earth Orbit (GEO) by utilizing existing technology to reduce the overall weight of the satellite, which gave rise to the small GEO satellite business model.

Small GEO is a telecommunication satellite platform that will able to accommodate a wide range of commercial missions and payloads for providing services such as TV broadcasting, internet, and voice using different frequency bands. The traditional GEO satellites have proved to the core commercial engine of the satellite industry. And the inception of private players, along with the government agencies, have leveraged some of the key communication market segments. In the era of the High Throughput Satellite (HTS) technology, the satellite industry is taking a new direction in the GEO market where low cost, high capacity, and efficiency are the top priorities for various Satellite Operators.

The concept of small GEO is not new, but in the last few years, start-ups and governments have made more efforts and investment in building and launching commercial small GEO Satellites. It aims to increase the competitiveness of the GEO satellite business by speeding up the production and testing process, reducing costsand broadening the range of design options. The quest to achieve a balance between the low cost and high bandwidth began since the small satellites have been more commercialized in using as with LEO satellite business models. But in the coming decade, small GEO satellites are said to keep this appropriate balance in the communications business by helping the downstream market to navigate for new business opportunities. Ovzon, Astranis, and GapSat are some of the new players in the small GEO market. Though many traditional GEO Satellite Operators are utilizing their current GEO capacity, HispaSat in Spain is one of the Satellite Operators to launch small GEO satellite Hispasat 36W-1 in January 2017.

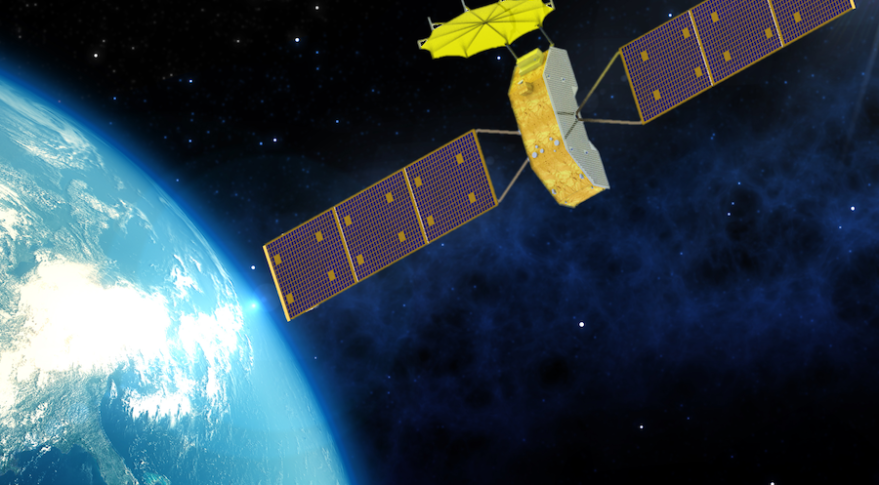

Image Credits: Boeing

Boeing is one of the prominent players to enter the small GEO manufacturing segment. The company unveiled its small GEO in September 2019, which was based on its previous Medium Earth Orbit (MEO) manufacturing line up of SES’s O3b mPower satellites. Boeing’s small GEO product will be a part of its 1900 kgs platform called “702X”; this platform enables the operators to adapt to changing market conditions by dynamically allocating bandwidth. Similarly, OHB System has been of the early entrants in the small GEO manufacturing segment. Currently, OHB System is a prime contractor for DLR’s Heinrich Hertz (H2Sat) mission that will be launching in 2021. The company will be utilizing its existing small GEO capabilities for developing the H2Sat mission, as the aim of this satellite is to test and examine various broadband communication technologies from a technical and scientific point of view.

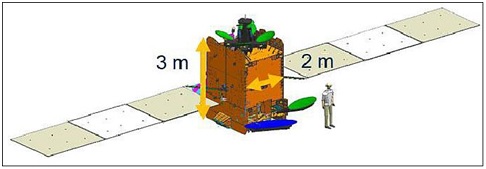

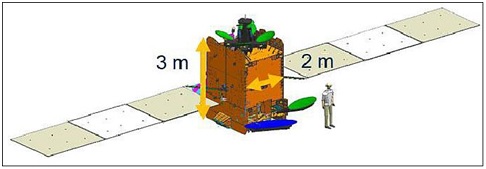

Source: eoPortal Directory (View of the Heinrich Hertz Satellite in a deployed configuration, Image Credit: OHB)

Small GEO satellites are set to change the complete satellite value chain by creating a strong impacting on both the satellite developers and operators. According to various government and commercial sources, more than 5000 small satellites (weighing less than 2000 Kg) will be launched by 2030. The small GEO satellite operators began to attract the investors because of low cost and reduction in the duration of the manufacturing of satellites. This will help the companies to deliver services at a much faster rate as compared to traditional GEO satellites. Though the GEO market experienced a slight fluctuation due to the rising investments in the LEO and MEO segments, the small GEO platform will reincarnate the traditional GEO market. Astranis, Ovzon, Saturn Satellite Networks, and GapSat are some of the new small GEO Satellite operators and manufacturers with a launch plan in between 2021 and 2023. Although Hispasat launched its first small GEO satellite — Hispasat 36W-1 — in January 2017, the satellite’s (dry mass) total weighed close to 1,700 kgs. On the other hand, Saturn Satellite Networks plans to build satellite ranging from (600-1,700) kgs. This drop in the overall weight of satellite is also going to reduce the launch cost as well as it will make satellite leasing prices more affordable than the traditional GEO satellites.

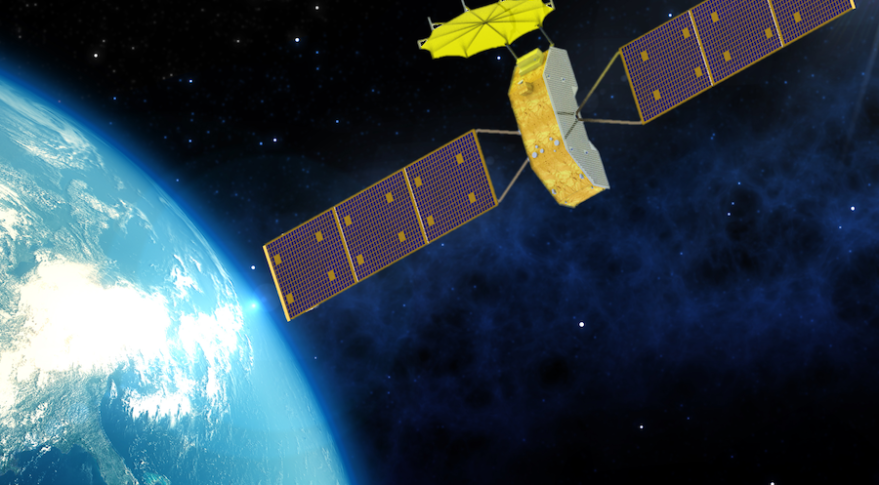

Image Credits: SpaceNews

The small GEO can thrive on the existing traditional GEO ground infrastructure, with little extra efforts for upgradations “if required”. The average life span of small GEO is going to be the same as the traditional GEO satellite; that is approximately 10 to 15 years. On the other hand, though, the LEO satellite will be manufactured and launched at a comparably lower cost than a small GEO, the investment is relatively still higher as LEO requires a big number of satellites for global connectivity. And the average life span of each LEO satellites is said to be approximately five to seven years, therefore more effort is required for de-orbiting satellite after the end-of-life service.

The growing number of new companies in the small GEO market signifies that the supply of satellite capacity is about to maximize in the coming years. One of the reasons is the increase in gigabits per second (Gbps); for example, according to various news sources, Astranis debut satellite will provide 7.5 Gbps of throughput. Therefore, In-flight connectivity (IFC), TV Broadcasting, Maritime, and Military are some of the verticals where Small GEO connectivity will be cost-effective as compared to the traditional GEO satellites.

The small GEO market is about to take off in the coming decade, and the future looks promising as the services will be more affordable and flexible for the downstream companies. From the perspective of a long life-span and less investment in the ground terminals, small GEO satellites will prove to beneficial for the developing nations currently trying to build independent space capabilities. Therefore, small GEO will be an arena where both government and commercial players can play a crucial role in exploring various business opportunities in the communications market. Simultaneously, the satellite manufacturing value chain will be benefited from both small GEO and LEO satellites, as the companies will receive an opportunity to iterate or experiment on various levels to create a new innovative sphere in the satellite manufacturing vertical.

The GEO satellite business has been tried and tested for more than two decades, and it has proved to be one of the commercially successful satellite business models for the communication industry. On the other hand, as LEO satellite operators are progressing to offer low latency as well as affordable communication services, the operators still need to go through various tests before deploying the communication services. The small GEO satellites will set a new tone for the GEO market by utilizing the latest space technologies to provide high bandwidth at a considerably low cost